-

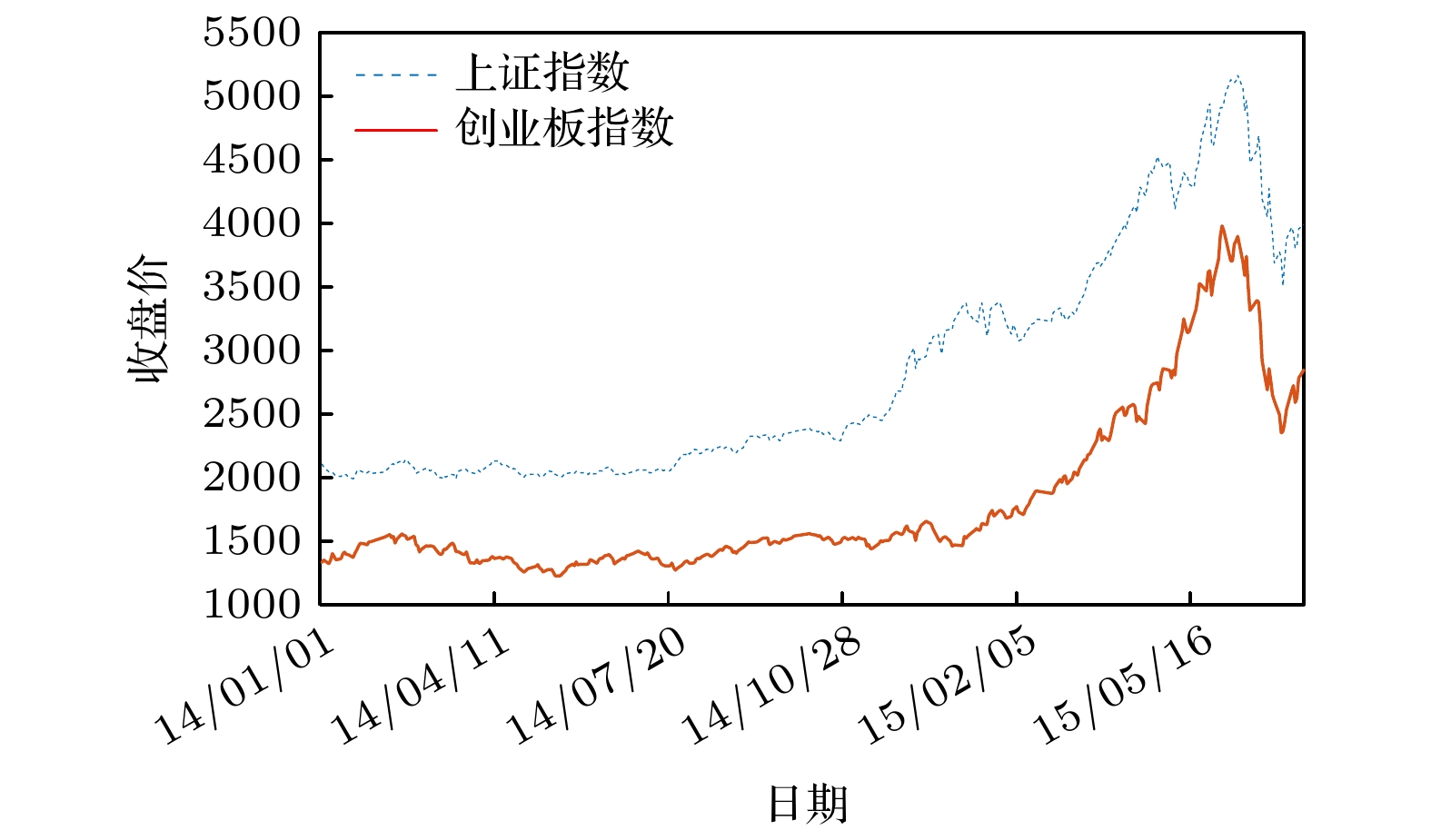

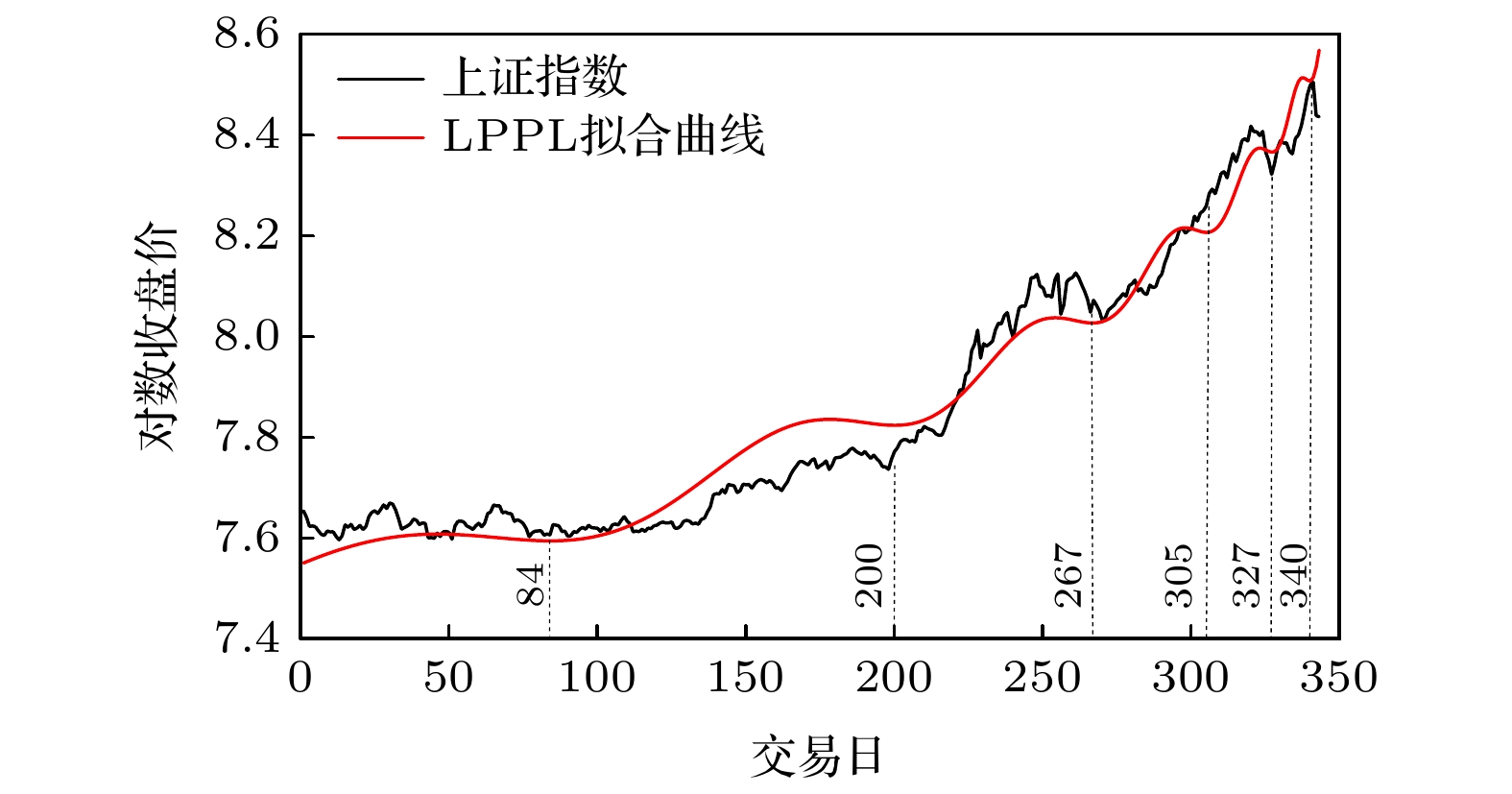

基于金融物理学中著名的对数周期幂律模型(log-periodic power law model, LPPL)来预警2015年6月份中国上证综合指数、创业板指数的崩盘. 鉴于已有采用LPPL模型预警市场崩盘的研究均只考虑市场历史交易数据. 本文将投资者情绪因素纳入到LPPL模型建模过程, 以改进LPPL模型的预警效果. 采用文本挖掘技术结合语义分析方法对抓取的财经媒体的股评报道进行词频统计, 以构建媒体情绪指数. 进一步修改LPPL模型中的崩溃概率函数表达式, 将其表示为关于历史交易数据及媒体情绪的函数, 构建LPPL-MS组合模型预警股市崩盘. 实证结果表明, 本文所构建的LPPL-MS组合模型相比LPPL模型具有更高的预警精度, 其预测的大盘见顶的临界时点与上证指数、创业板指数真实的见顶时点更为接近, 并且其拟合结果通过了相关检验.This paper is based on the famous log-periodic power law model (LPPL) in financial physics to warn of the collapse of China's Shanghai Composite Index and GEM Index in June 2015. In view of the existing research using the LPPL model to warn of market crash, only the historical trading data of the market are considered. For the first time, investor sentiment factors are incorporated into the modeling process of LPPL model to improve the early warning effect of LPPL model. Using the text mining technology combined with semantic analysis methods to grasp the financial media's stock evaluation report for word frequency statistics, in order to build the medium sentiment index. The further modified expression of the crash probability function in the LPPL model is represented as a function of historical trading data and medium sentiment, and thus constructing an LPPL-MS combination model to warn of stock market crash. The empirical results show that the LPPL-MS combination model constructed in this paper has higher warning accuracy than the LPL model, and its prediction crash time is closer to the actual crash time of the Shanghai Index and GEM Index, and its fitting results have passed the relevant test.

-

Keywords:

- LPPL-MS model /

- medium sentiment /

- stock market crash /

- warning

[1] Sornette D, Johansen A, Bouchaud J P 1995 J. Phys. I. 6 167

Google Scholar

Google Scholar

[2] Johansen A, Sornette D 1999 Risk. 12 91

[3] Jensen M C 1967 Financ. Anal. J. 23 77

[4] Fama U 1965 J. Bus. 38 34

Google Scholar

Google Scholar

[5] 蒋志强, 田婧雯, 周炜星 2019 管理科学学报 22 92

Google Scholar

Google Scholar

Jiang Z Q, Tian J W, Zhou W X 2019 J. Manag. Sci. China 22 92

Google Scholar

Google Scholar

[6] 徐翔, 朱承, 朱先强 2021 70 088901

Google Scholar

Google Scholar

Xu X, Zhu C, Zhu X Q 2021 Acta Phys. 70 088901

Google Scholar

Google Scholar

[7] Gurkaynak R S 2008 J. Econ. Sury. 22 166

Google Scholar

Google Scholar

[8] Bak P, Tang C, Wiesenfeld K 1987 Phys. Rev. Lett. 59 381

Google Scholar

Google Scholar

[9] 潘娜, 王子剑, 周勇 2018 中国管理科学 26 25

Google Scholar

Google Scholar

Pan N, Wang Z J, Zhou Y 2018 Chin. J. Manag. Sci. 26 25

Google Scholar

Google Scholar

[10] 周炜星 2007 金融物理学导论 (上海: 上海财经大学出版社) 第17—33页

Zhou W X 2007 Introduction of Econophysics (Shang-hai: Shanghai University of Finance and Economics Press) pp17–33 (in Chinese)

[11] Sornette D, Johansen A 1997 Physica A 245 411

Google Scholar

Google Scholar

[12] Sornette D, Johansen A 1998 Physica A 261 581

Google Scholar

Google Scholar

[13] Sornette D, Zhou W X 2006 Int. J. Forecast 22 153

Google Scholar

Google Scholar

[14] Sornette D, Woodard R, Zhou W X 2009 Physica A 388 1571

Google Scholar

Google Scholar

[15] Kyriazis N, Papadamou S, Corbet S 2020 Res. Int. Bus. Financ. 54 101254

Google Scholar

Google Scholar

[16] Omer O 2020 Eur. Phys. J. Spec. Top. 229 1715

Google Scholar

Google Scholar

[17] Sirca S J, Omladic M 2020 ARS Math. Contemp. 13 63

[18] Filimonov V, Sornette D 2013 Physica A 392 3698

Google Scholar

Google Scholar

[19] Jiang Z, Zhou W X, Sornette D, et al. 2010 J. Econ. Behav. Organ. 74 149

Google Scholar

Google Scholar

[20] Yan W, Rebib R, Woodard R, Sornette D 2012 IJPAM. 1 59

Google Scholar

Google Scholar

[21] 李东 2012 淮海工学院学报(自然科学版) 21 4

Li D 2012 J. Huaihai Insti of Tech. (Natural Science Edition) 21 4

[22] 周伟, 何建敏 2011 金融研究 375 65

Zhou W, He J M 2011 J. Financ. Res. 375 65

[23] 李斯嘉, 李冬昕, 王粟旸 2017 上海经济研究 7 42

Li S J, Li D X, Wang L Y 2017 Shanghai J. Econ. 7 42

[24] 李伦一, 张翔 2019 金融研究 474 169

Li L Y, Zhang X 2019 J. Financ. Res. 474 169

[25] 陈卫华, 蔡文靖 2018 统计与决策 497 143

Google Scholar

Google Scholar

Chen W H, Cai W J 2018 Statistics and Decision 497 143

Google Scholar

Google Scholar

[26] 赵磊, 刘庆 2020 统计与决策 558 128

Google Scholar

Google Scholar

Zhao L, Liu Q 2020 Statistics and Decision 558 128

Google Scholar

Google Scholar

[27] Kahneman D 2003 Am. Econ. Rev. 93 1449

Google Scholar

Google Scholar

[28] Baker M, Wurgler J 2006 J. Financ. 61 1645

Google Scholar

Google Scholar

[29] Baker M, Wurgler J 2007 J. Econ. Perspect 21 129

Google Scholar

Google Scholar

[30] García D 2013 J. Financ. 68 1267

Google Scholar

Google Scholar

[31] Fang L, Peress J 2009 J. Financ. 64 2023

Google Scholar

Google Scholar

[32] Barber B M, Odean T 2008 Rev. Financ. Stud. 21 785

Google Scholar

Google Scholar

[33] Solomon D H 2012 J. Financ. 67 599

Google Scholar

Google Scholar

[34] Nardo M, Petracco-Giudici M, Naltsidis M 2016 J. Econ. Surv. 30 356

Google Scholar

Google Scholar

[35] Fisher K L, Statman M 2000 Financ. Anal. J. 56 16

Google Scholar

Google Scholar

[36] 武佳薇, 汪昌云, 陈紫琳, Jie Michael Guo 2020 金融研究 476 147

Wu J W, Wang C Y, Chen Z L, Jie M G 2020 J. Financ. Res. 476 147

[37] 李合龙, 冯春娥 2014 系统工程理论与实践 34 2495

Google Scholar

Google Scholar

Li H L, Feng C E 2014 System Eng. Theor. Prac. 34 2495

Google Scholar

Google Scholar

[38] 游家兴, 吴静 2012 经济研究 534 141

You J X, Wu J 2012 Econ. Res. J 534 141

[39] Wu D D, Zheng L, Olson D L 2014 IEEE T. SYST Man CY-S. 44 1077

Google Scholar

Google Scholar

[40] 戴德宝, 兰玉森, 范体军, 赵敏 2019 中国软科学 340 166

Google Scholar

Google Scholar

Dai D B, Lan Y S, Fan T J, Zhao M 2019 China Soft Sci. 340 166

Google Scholar

Google Scholar

[41] Martin G 1971 In Computers, Communication, and the Public Interest (Baltimore, MD: The Johns Hopkins Press) p37

[42] Da Z, Engelberg J, Gao P 2011 J. Financ. 66 1461

Google Scholar

Google Scholar

[43] Huang X, Nekrasov A, Teoh S H 2018 Account. Rev. 93 231

Google Scholar

Google Scholar

[44] Sentiment Analysis, Bian S B, Jia D K, Li F http://dx.doi.org/10.2139/ssrn.3446388 [2020-11-10]

[45] 王晓丹, 尚维, 汪寿阳 2019 系统工程理论与实践 39 3038

Google Scholar

Google Scholar

Wang X D, Shang W, Wang S Y 2019 System Eng. Theor. Prac. 39 3038

Google Scholar

Google Scholar

[46] Johansen A, Ledoit O, Sornette D. 2000 Int J Theor Appl Finan. 3 219

Google Scholar

Google Scholar

[47] Yan W F, Woodard R, Sornette D 2014 Quant. Financ. 14 1273

Google Scholar

Google Scholar

[48] Lin L, Sornette D 2013 Eur. J. Financ. 19 344

Google Scholar

Google Scholar

-

表 1 CFSD词典部分积极、消极词汇

Table 1. Some positive and negative words in CFSD dictionary.

序号 积极词汇 消极词汇 1 突破 拖累 2 增长 不涨反跌 3 高涨 分化 4 火爆 沉重打击 5 赚钱 恐慌 6 上升 下降 7 一枝独秀 狂跌 8 蒸蒸日上 跌停板 9 活跃 退市 10 提速 暴涨暴跌 表 2 (MS)序列描述性统计分析

Table 2. Descriptive statistical analysis of media sentiment(MS) sequence.

最大值 最小值 均值 标准差 偏度 峰度 1.794 –0.998 0.252 0.446 0.037 3.158 表 3 上证指数LPPL, LPPL-MS参数估计结果

Table 3. Parameter estimation results of SSE index LPPL and LPPL-MS.

MSE A B C m ω ϕ λ $ {t_{\text{c}}} $ LPPL 0.997 10.131 –0.864 –0.017 0.188 12.098 1.748 — 369.022 1.078 10.161 –0.828 –0.015 0.197 11.991 1.840 — 379.036 1.112 9.949 –0.805 0.014 0.188 10.368 2.029 — 361.668 LPPL-MS 0.948 9.639 –0.562 –0.014 0.226 12.398 6.686 0.008 362.729 0.991 9.597 –0.509 –0.013 0.240 12.911 3.717 0.007 365.669 1.038 9.552 –0.508 –0.012 0.237 12.953 3.671 0.010 360.949 表 4 创业板指数LPPL、LPPL-MS参数估计结果

Table 4. Estimation results of LPPL and LPPL-MS parameters of gem index.

MSE A B C m ω ϕ λ $ {t_{\text{c}}} $ LPPL 2.429 8.444 –0.334 0.006 0.239 13.988 2.241 — 335.923 2.443 8.654 –0.436 –0.015 0.217 13.009 3.989 — 341.826 2.477 8.517 –0.355 –0.011 0.236 13.039 3.998 — 340.435 LPPL-MS 2.703 8.617 –0.395 0.011 0.229 15.242 0.288 0.015 344.122 2.819 9.218 –0.766 0.016 0.174 16.445 5.320 0.010 352.216 2.904 8.922 –0.559 0.010 0.200 21.717 0.256 0.010 353.759 表 5 上证指数、创业板指数预警误差比较分析

Table 5. Comparative analysis of early warning errors between SSE index and GEM index.

最低绝

对误差最高绝

对误差平均绝

对误差LPPL 上证指数 9 27 18 创业板指 4 10 7 LPPL-MS 上证指数 8* 13* 11* 创业板指 1* 8* 6* 注: *表明预测的见顶时点最接近真实值. 表 6 上证指数、创业板指数不同拟合情形下残差平稳性检验

Table 6. Residual stationarity test of SSE index and GEM index under different fitting conditions.

拟合情形1 拟合情形2 拟合情形3 LPPL 上证指数 0.014** 0.021** 0.013** 创业板指 0.0428** 0.073* 0.0959* LPPL-MS 上证指数 0.001*** 0.001*** 0.012** 创业板指 0.019** 0.041** 0.074* 注: *表明在10%水平下显著; **表明在5%水平下显著; ***表明在1%水平下显著. -

[1] Sornette D, Johansen A, Bouchaud J P 1995 J. Phys. I. 6 167

Google Scholar

Google Scholar

[2] Johansen A, Sornette D 1999 Risk. 12 91

[3] Jensen M C 1967 Financ. Anal. J. 23 77

[4] Fama U 1965 J. Bus. 38 34

Google Scholar

Google Scholar

[5] 蒋志强, 田婧雯, 周炜星 2019 管理科学学报 22 92

Google Scholar

Google Scholar

Jiang Z Q, Tian J W, Zhou W X 2019 J. Manag. Sci. China 22 92

Google Scholar

Google Scholar

[6] 徐翔, 朱承, 朱先强 2021 70 088901

Google Scholar

Google Scholar

Xu X, Zhu C, Zhu X Q 2021 Acta Phys. 70 088901

Google Scholar

Google Scholar

[7] Gurkaynak R S 2008 J. Econ. Sury. 22 166

Google Scholar

Google Scholar

[8] Bak P, Tang C, Wiesenfeld K 1987 Phys. Rev. Lett. 59 381

Google Scholar

Google Scholar

[9] 潘娜, 王子剑, 周勇 2018 中国管理科学 26 25

Google Scholar

Google Scholar

Pan N, Wang Z J, Zhou Y 2018 Chin. J. Manag. Sci. 26 25

Google Scholar

Google Scholar

[10] 周炜星 2007 金融物理学导论 (上海: 上海财经大学出版社) 第17—33页

Zhou W X 2007 Introduction of Econophysics (Shang-hai: Shanghai University of Finance and Economics Press) pp17–33 (in Chinese)

[11] Sornette D, Johansen A 1997 Physica A 245 411

Google Scholar

Google Scholar

[12] Sornette D, Johansen A 1998 Physica A 261 581

Google Scholar

Google Scholar

[13] Sornette D, Zhou W X 2006 Int. J. Forecast 22 153

Google Scholar

Google Scholar

[14] Sornette D, Woodard R, Zhou W X 2009 Physica A 388 1571

Google Scholar

Google Scholar

[15] Kyriazis N, Papadamou S, Corbet S 2020 Res. Int. Bus. Financ. 54 101254

Google Scholar

Google Scholar

[16] Omer O 2020 Eur. Phys. J. Spec. Top. 229 1715

Google Scholar

Google Scholar

[17] Sirca S J, Omladic M 2020 ARS Math. Contemp. 13 63

[18] Filimonov V, Sornette D 2013 Physica A 392 3698

Google Scholar

Google Scholar

[19] Jiang Z, Zhou W X, Sornette D, et al. 2010 J. Econ. Behav. Organ. 74 149

Google Scholar

Google Scholar

[20] Yan W, Rebib R, Woodard R, Sornette D 2012 IJPAM. 1 59

Google Scholar

Google Scholar

[21] 李东 2012 淮海工学院学报(自然科学版) 21 4

Li D 2012 J. Huaihai Insti of Tech. (Natural Science Edition) 21 4

[22] 周伟, 何建敏 2011 金融研究 375 65

Zhou W, He J M 2011 J. Financ. Res. 375 65

[23] 李斯嘉, 李冬昕, 王粟旸 2017 上海经济研究 7 42

Li S J, Li D X, Wang L Y 2017 Shanghai J. Econ. 7 42

[24] 李伦一, 张翔 2019 金融研究 474 169

Li L Y, Zhang X 2019 J. Financ. Res. 474 169

[25] 陈卫华, 蔡文靖 2018 统计与决策 497 143

Google Scholar

Google Scholar

Chen W H, Cai W J 2018 Statistics and Decision 497 143

Google Scholar

Google Scholar

[26] 赵磊, 刘庆 2020 统计与决策 558 128

Google Scholar

Google Scholar

Zhao L, Liu Q 2020 Statistics and Decision 558 128

Google Scholar

Google Scholar

[27] Kahneman D 2003 Am. Econ. Rev. 93 1449

Google Scholar

Google Scholar

[28] Baker M, Wurgler J 2006 J. Financ. 61 1645

Google Scholar

Google Scholar

[29] Baker M, Wurgler J 2007 J. Econ. Perspect 21 129

Google Scholar

Google Scholar

[30] García D 2013 J. Financ. 68 1267

Google Scholar

Google Scholar

[31] Fang L, Peress J 2009 J. Financ. 64 2023

Google Scholar

Google Scholar

[32] Barber B M, Odean T 2008 Rev. Financ. Stud. 21 785

Google Scholar

Google Scholar

[33] Solomon D H 2012 J. Financ. 67 599

Google Scholar

Google Scholar

[34] Nardo M, Petracco-Giudici M, Naltsidis M 2016 J. Econ. Surv. 30 356

Google Scholar

Google Scholar

[35] Fisher K L, Statman M 2000 Financ. Anal. J. 56 16

Google Scholar

Google Scholar

[36] 武佳薇, 汪昌云, 陈紫琳, Jie Michael Guo 2020 金融研究 476 147

Wu J W, Wang C Y, Chen Z L, Jie M G 2020 J. Financ. Res. 476 147

[37] 李合龙, 冯春娥 2014 系统工程理论与实践 34 2495

Google Scholar

Google Scholar

Li H L, Feng C E 2014 System Eng. Theor. Prac. 34 2495

Google Scholar

Google Scholar

[38] 游家兴, 吴静 2012 经济研究 534 141

You J X, Wu J 2012 Econ. Res. J 534 141

[39] Wu D D, Zheng L, Olson D L 2014 IEEE T. SYST Man CY-S. 44 1077

Google Scholar

Google Scholar

[40] 戴德宝, 兰玉森, 范体军, 赵敏 2019 中国软科学 340 166

Google Scholar

Google Scholar

Dai D B, Lan Y S, Fan T J, Zhao M 2019 China Soft Sci. 340 166

Google Scholar

Google Scholar

[41] Martin G 1971 In Computers, Communication, and the Public Interest (Baltimore, MD: The Johns Hopkins Press) p37

[42] Da Z, Engelberg J, Gao P 2011 J. Financ. 66 1461

Google Scholar

Google Scholar

[43] Huang X, Nekrasov A, Teoh S H 2018 Account. Rev. 93 231

Google Scholar

Google Scholar

[44] Sentiment Analysis, Bian S B, Jia D K, Li F http://dx.doi.org/10.2139/ssrn.3446388 [2020-11-10]

[45] 王晓丹, 尚维, 汪寿阳 2019 系统工程理论与实践 39 3038

Google Scholar

Google Scholar

Wang X D, Shang W, Wang S Y 2019 System Eng. Theor. Prac. 39 3038

Google Scholar

Google Scholar

[46] Johansen A, Ledoit O, Sornette D. 2000 Int J Theor Appl Finan. 3 219

Google Scholar

Google Scholar

[47] Yan W F, Woodard R, Sornette D 2014 Quant. Financ. 14 1273

Google Scholar

Google Scholar

[48] Lin L, Sornette D 2013 Eur. J. Financ. 19 344

Google Scholar

Google Scholar

计量

- 文章访问数: 8961

- PDF下载量: 140

- 被引次数: 0

下载:

下载: